Having supported corporates and developers in PPA deals across Europe, we have seen major changes in this market over the past few years and we reflect on how the market is likely to evolve in the future.

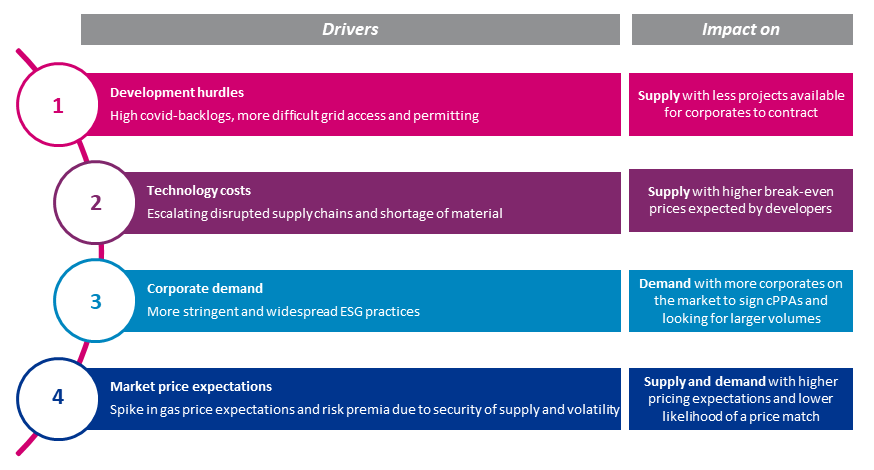

PPA price levels have recently spiked. Several drivers have been at play affecting, on the one hand, the demand and supply balance, and on the other, the underlying price expectations of buyers and sellers for these corporate deals.

On the supply side, RES projects have become slower to build and more expensive. Covid related backlogs, permitting hurdles and increased scarcity of grid capacity have reduced the depth of the project pipeline available to contract (1 in the diagram below). The cost of renewables (2), and higher PPA break-even prices for projects, have increased for a combination of sequential factors:

- At first, Covid related supply chain issues in combination with increased demand for raw material and equipment prompted by the economic recovery. This was followed by

- Events in Ukraine intensifying the inflationary pressure through skyrocketing energy costs, and further reshoring of supply chains. More recently,

- Increasing cost of capital for energy infrastructure, including renewable projects, due to the tightening of capital availability and the persistent inflationary environment.

On the demand side, enhanced sustainability targets, with progressively more stringent criteria, have significantly increased the requirements of procuring green electricity directly from renewable energy projects (3). Appetite for such deals has soared further because of the desire to reduce the exposure to uncertain and volatile energy prices (4) observed since the events in Ukraine.

These supply and demand drivers are summarised in the diagram below:

Until very recently, such supply and demand trends have played out in a market environment dominated by high power price expectations, fuelled by security of supply concerns, volatility, and uncertainty premia priced in traded products. This environment has enabled renewable developers to expect, and corporates to accept, higher PPA prices, above minimum break-even levels and below expected costs, respectively. Albeit at a slightly slower pace in some geographies, a significant number of corporate PPA deals have been closed over the last few years.

Developers and corporate consumers now face a different environment, with dynamics of PPA pricing changing in most European markets. Expectations of future power prices have considerably stabilised around much lower levels. This means that the urgency of building long-term positions via PPAs, as a mitigation against escalating and volatile power prices, has partially softened. From the developers’ perspective though, technology and capital costs have not significantly moved downward, therefore projects still require relatively high break-even PPA prices. In many cases, these are more difficultly aligned with expectations of future market prices and price levels executable by corporate buyers.

This situation is illustrated in the chart above. The grey line stands for the evolution of PPA break-even prices – i.e., lowest prices acceptable by renewables projects to cover their costs and minimum returns. This level is compared against the fair value PPA prices (black line), which reflect the renewables production valued at market prices. In today’s market, PPA deals are typically at premium to fair value in multiple geographies across Europe.

Closing sustainable PPA deals from a pure pricing perspective is expected to remain temporarily challenging, at least over the near term until technology and capital costs realign with expected power prices. In this unfamiliar environment, however, price levels are not the only challenge.

Developers are reconsidering Government-backed route-to-markets – e.g., CfDs or grants via competitive processes – as a hybrid (together with PPAs) or as an exclusive option to monetise their production. This may create competition for projects, with consumers needing to pay a premium to secure green electricity with additionality, should these Government schemes offer more value than market-based solutions, such as cPPAs.

There are also more significative divergences in preferences around pricing structures, and other key commercial terms – e.g., negative prices, inflation, termination events – between buyers, sellers, and their financiers. This is generally driven by their heightened perception of risk. Deals are shifting away from baseload towards pay-as-produced, also in markets historically comfortable with such baseload structures (e.g., the Nordics), and/or corporates find more helpful pricing for baseload products from traditional suppliers, than pay-as-produced from (new) renewables projects.

While we expect the negotiation gap between an average developer and an average corporate to continue in the near term in several European markets, the medium and long-term fundamentals for the PPA market have never looked healthier. Both buyers and sellers do consider cPPAs as a core solution to their needs.

To discuss how Baringa can support your use of PPAs, please get in touch.

Our Experts

Related Insights

Next steps for the UK renewable energy industry

Join us for this webinar where we’ll be discussing the impact of recent developments on the UK’s Contracts for Difference (CfD) subsidy scheme.

Read more

European power markets: Navigating the new normal and looking to the future

How will the power markets evolve in 2024 and beyond? Watch the playback of this webinar to access our analysis.

Read more

Financing the energy transition in a volatile market

We examine the recent disruptions that have affected the financing of renewable energy projects in Europe over the past 18 months.

Read more

India’s complex and rapid energy transition presents major opportunities for investors

Baringa's India Reference Case provides a comprehensive overview of the Indian power market and an independent perspective on the demand and supply-side changes.

Read moreRelated Case Studies

Shaping a self-generation strategy for a major data centre

How do you develop an energy generation plan that balances sustainability with commercial due diligence?

Read more

Evaluating the case for the world’s biggest offshore wind project

We helped our client reach financial close for all three phases of the project, securing 15-year CfDs with delivery between 2023-2025.

Read more

Green Hydrogen value-chains unpacked

Mapping and analysis of the potential of Green Hydrogen across multiple European markets helped our client’s strategic focus and investment decision-making.

Read more

Working with Netbeheer Nederland, we helped the Netherlands’ grid get to grips with solar

New solar panels are installed across the Netherlands daily. Each one is a step towards a greener energy system but only if that system is set up to use them.

Read more