Five key insights from the Baringa Consumer Spending Outlook 2025: Who's gaining, getting squeezed, or treading water?

5 min read 27 February 2025

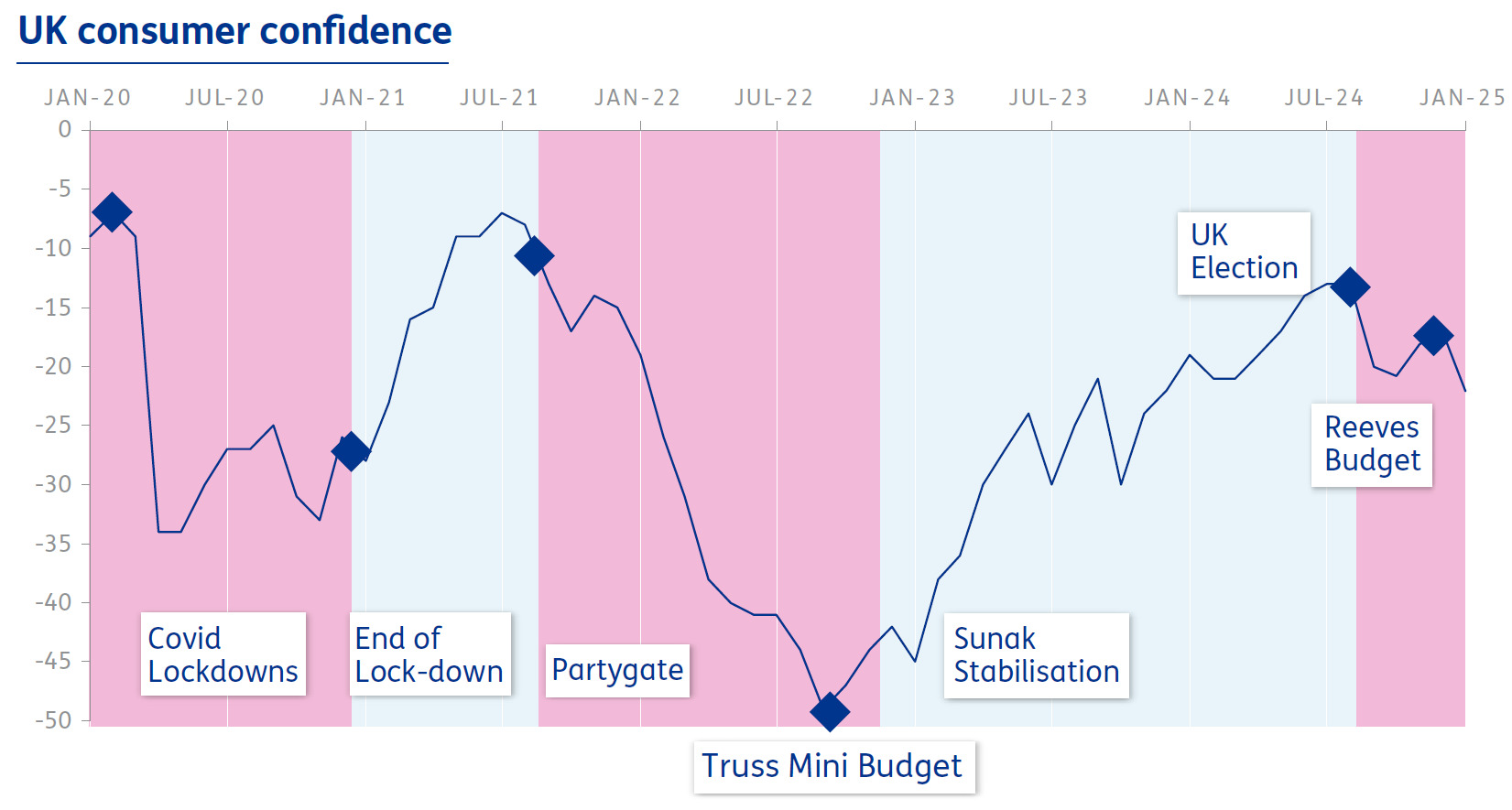

2025 promised a comeback for UK retail and consumer packaged goods (CPGs) businesses. Instead, they’re still weathering strong headwinds from rocky economic conditions, higher labour costs coming down the track, and unsteady consumer confidence. Amidst this continued uncertainty, many businesses have been challenged to find safe harbours of growth and profitability.

That’s why we developed the Baringa Consumer Spending Model. Our bottom-up model offers insight into the growth potential of different demographic groups and consumer categories, as well as how they react to varying economic circumstances. It’s a powerful tool for helping retailers and CPGs to understand exactly where their risks and opportunities lie, so they can optimise their positioning and capture maximum potential growth in consumer spend.

In this article, we draw on the latest insights from our model to reveal five trends that will set the tone for consumer products as well as retailers and CPGs in the year ahead.

|

About the Baringa Consumer Products Model Baringa’s Consumer Spending Model analyses expenditure patterns from the 28 million households in the UK. Unlike standard consumer surveys, our model is based on solid economic fundamentals, granular household level data and robust scenario analysis. It examines variances in spending across household size, regional locations, household age, and other demographic factors to offer a comprehensive overview of purchasing behaviours across multiple consumer groups and product categories. For our 2025 analysis, we have generated three distinct scenarios, each accounting for variations in key economic factors:

|

1. Consumer spending growth returns to pre-pandemic levels

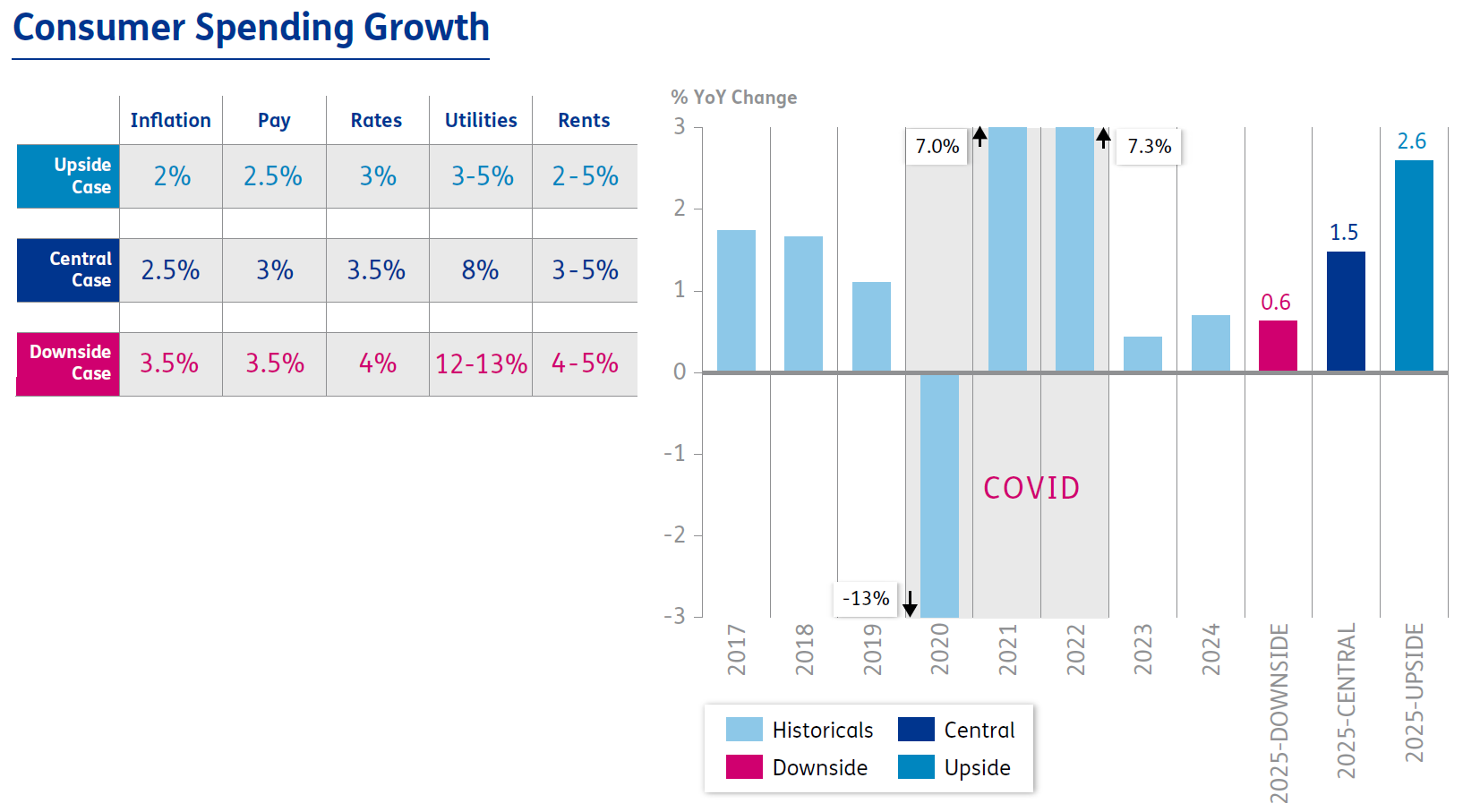

After years of subdued discretionary income growth due to the twin shocks of high inflation and high interest rates, our outlook for consumer spending growth in 2025 is positive. We expect spending growth to reach around 1.5% in our central case.

This anticipated return to pre-pandemic levels is driven by rising real wages and falling interest rates. Minimum wage increases and ongoing labour shortages amongst the bottom quartile of income earners have led to higher nominal pay growth in recent years compared to those in higher-income brackets. This trend is expected to persist into 2025, particularly due to policy changes that will further increase the minimum wage.

While the central case scenario remains our most likely outcome, the probability of a downside scenario is increasing. This downside case reflects higher inflation and interest rates, which could reduce consumer spending growth to just 0.6%. Retailers and CPGs should keep a careful eye on these macro-economic indicators and how they might influence consumer purchasing decisions. Baringa’s Consumer Spending Model can support translating macro-conditions into their micro context.

2. In an uneven rebound, fortune favours the homeowner

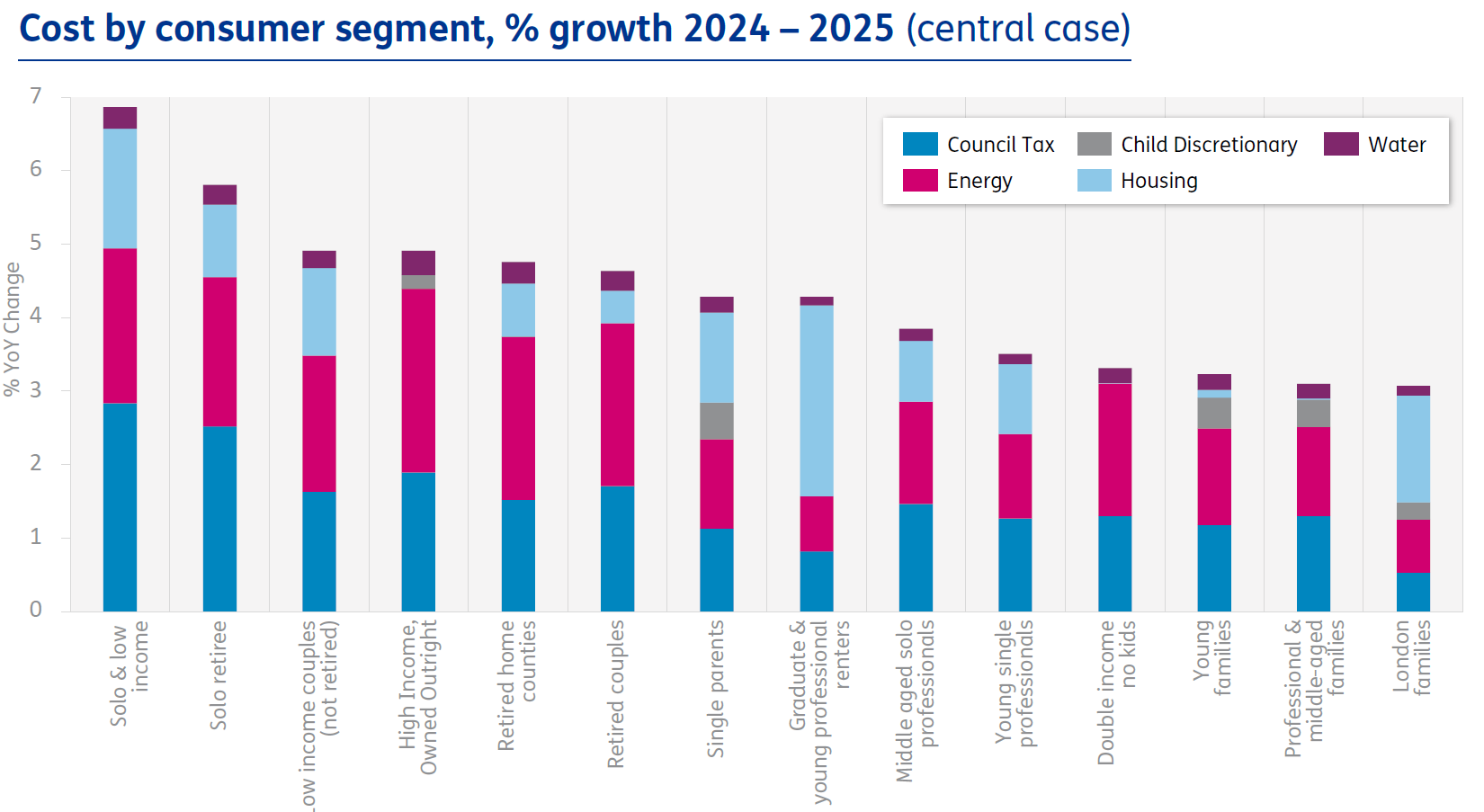

Discretionary spending will continue to vary significantly across different demographic groups, driven by variations in nominal pay and costs. By keeping a close eye on these changing fortunes, retailers and CPGs can better anticipate how consumer confidence and spending patterns will ebb and flow among different demographics.

With interest rates expected to decline, mortgage holders stand to gain, with forecasted average annual savings of £5,670 driving a rebound in discretionary spending. Likewise, young families and professional and middle-aged families are poised for growth, with discretionary incomes projected to rise by 2.5% or more in 2025.

On the flip side, consumer segments such as young renters and low-income families continue to face significant challenges due to high rental inflation and weak real wage growth. These groups are expected to see only modest increases in discretionary income, averaging just 1%. Year-on-year costs for the lowest-income groups are also set to rise at the highest rate of all demographics, in no small part due to housing costs.

3. Some high-growth segments come with downside risks

3. Some high-growth segments come with downside risks

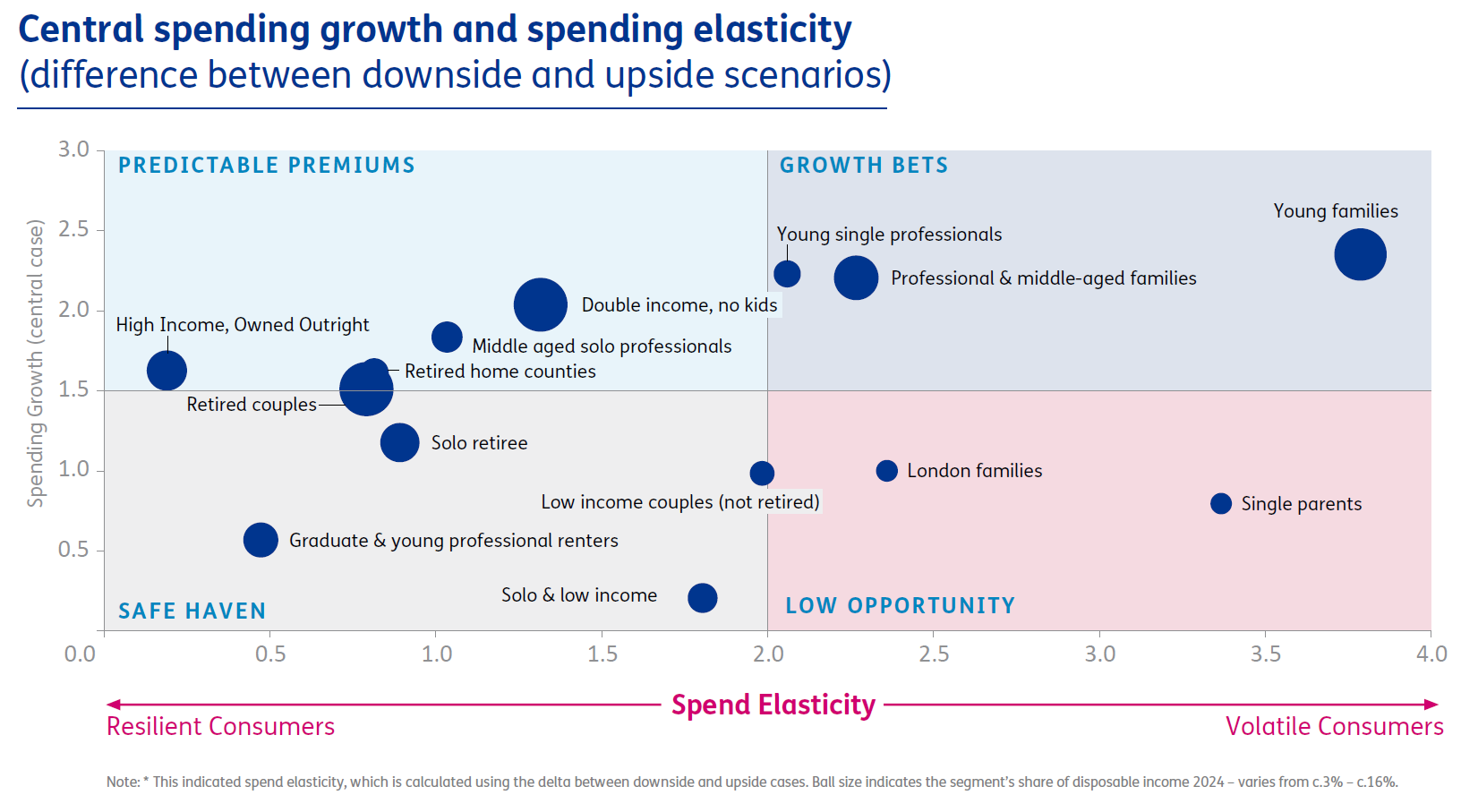

If economic conditions take a turn for the worse, traditional high-growth segments could be at risk. In our model’s downside case, central-case winners such as young families could face setbacks due to less interest rate cuts and lower real pay growth . Meanwhile, retired couples and dual income, no kids (DINKS) segments are expected to perform comparatively well, with growth ranging from 1.5% to 2% due to lower mortgage exposure and higher disposable incomes.

To hedge against this uncertainty, retailers and CPG’s must build a more detailed and targeted understanding of consumer segments. As an example, we’ve divided the consumer groups included in our model into four target segments, based on their potential for growth and resilience:

- Predictable premiums. Groups with high spend growth in our central case, as well as high resilience to our downside case due to low spending elasticity.

- Growth bets. Groups with high spend growth, but low resilience to our downside case due to high spending elasticity.

- Safe havens. Groups with low spend growth, but high resilience to our downside case.

- Low Opportunity. Groups with low spend growth and low resilience to our downside case.

Note: the Y-axis represents our central case growth and the x-axis represents the difference between our upside and downside scenarios, indicating elasitcity of each consumer segment. The ball size equates to the size of total discretionary spending for the group.

4. For predictable growth opportunities, look outside of London

Consumers based in London are more sensitive to economic fluctuations in part due to larger mortgages. These segments show spending growth in our central case, but heightened vulnerability in a downside scenario. In contrast, regional markets outside of London present a more stable environment for consistent growth, offering brands a safer avenue for long-term planning.

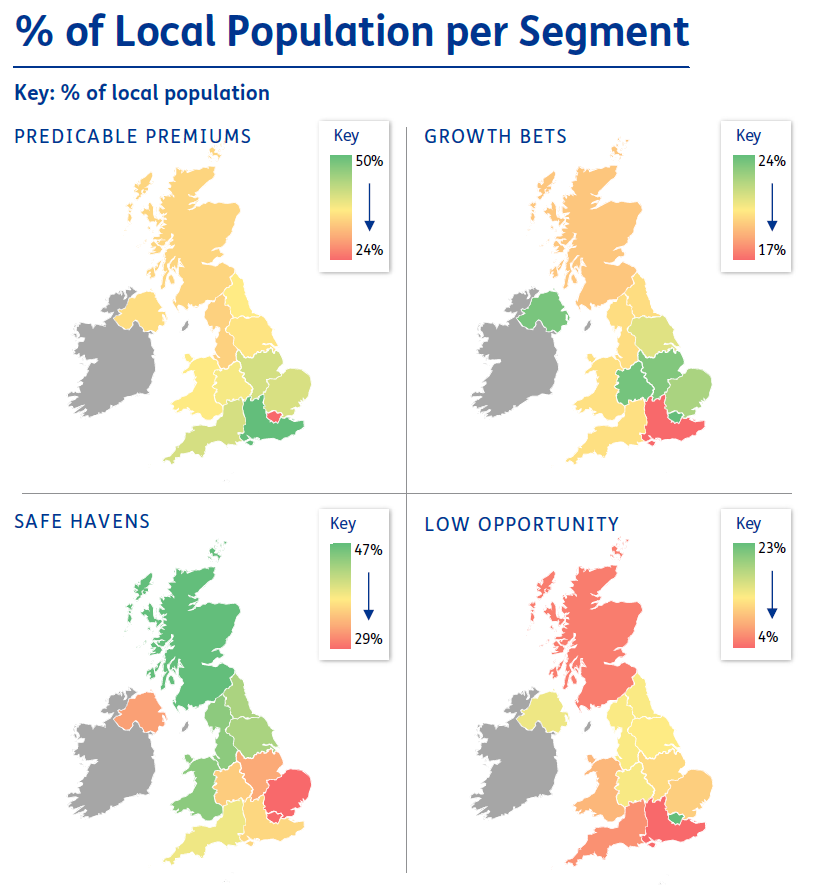

Below, we’ve mapped our four target segments onto different regions of the UK. Taking these regional variations into account may influence retailers’ geographic strategy.

- Predictable premiums – significant parts of the South East, but with a low rate of exposure to London.

- Growth bets – a large proportion of the midlands, East Anglia, Northern Ireland and London.

- Safe havens – large proportions of Wales, the North and Scotland.

- Low Opportunity – large proportions of London and major urban centers.

5. Product category spending is on the rise, but not evenly

Our product category forecast shows considerable variation in spending growth. These differences are driven by the asymmetric discretionary spending growth of different consumer segments and their relative propensity to spend on product categories associated with their income, geography, age, and family composition.

Delving deeper into the data, we’ve drawn out three micro-trends at the product category level:

- Going out is the new staying in. 10 (out of 14) consumer segments in our central case will prioritise an out-of-home leisure activity (cinema, theatre, etc.) above everything else. Yet, entertainment remains much more sensitive to wider economic shifts than categories like clothing and food and drink. Should the economy move towards our downside case, entertainment will be one of the first sacrifices, with consumer spend likely to fall sharply.

- Fashion’s middle ground is shrinking. In 2025, we expect to see mid-market clothing retailers squeezed, continuing a trend from the last few years. Polarized consumers at the top and bottom of the spectrum will continue to focus on a few key luxury pieces and supplement with basics from value outlets.

- Grocery customers shopping around. Consumers will continue to favour ‘at-home treats’ from specialist food and drink outlets over eating out. In 2025 we’ll also see grocery customers broadening their repertoire, moving away from one-stop shops and visiting a variety of specialists and discounters to cater to their needs.

Retailers and CPGs looking to capture growth opportunities in 2025 will need to focus their portfolio mix and offerings very carefully on the segments they need to attract in alignment with their risk / growth appetite.

Navigating constant change to reach real value

Retailers and CPGs must keep their fingers on the pulse of consumer trends and pivot fast when conditions change. Achieving this level of insight and agility demands reliable data and flexible processes. Baringa can help you build both.

Blending unique resources like our Consumer Spending Model with deep consumer products and retail expertise, we allow you to understand how consumers are thinking, feeling, and acting. Working alongside your teams, we help your business harness the latest consumer and market insights to shape sharper strategies and operating models – driving value and growth for your business in an ever-changing world.

If you’re interested in exploring more insights from Baringa’s Consumer Spending Model, or if you’d like to discuss how we can help refine your strategy and operations, get in touch with us today.

Related Insights

Preparing for the EU's regulation on deforestation-free products

Is your supply chains prepared for the incoming EU Deforestation Regulation? In this article we share what you need to know in preparation for the new regulation, and how Baringa can help you.

Read more

Achieving the benefits of a multi-brand product portfolio

Download our blog on achieving the benefits of a multi-brand product portfolio.

Read more

Trading team optimisation: time to add value

Trading team optimisation: How team structures and ways of working can help trading teams make fast, informed decisions.

Read more

Become digital podcast: Episode 2 - Pret a Manger

Baringa are joined by Pret a Manger to discuss their digital journey, strategies, response to Covid-19, Pret's coffee subscription service and more

Read moreRelated Client Stories

Freeing up £500m+ in cost savings for investment in new growth and future value at a global FMCG business

How can you improve margin, boost operational resilience and accelerate innovation across a global business?

Read more

Transforming digital capabilities for one of the UK’s best-loved food and coffee chains

Read about how we put our client’s users first to design market-leading digital products.

Read more

Helping an American personal care company become a truly digital business

How can you prepare for the future of e-commerce?

Read more

Restructuring a FTSE 10 health, hygiene and nutrition business into a multi business unit organisation

Read about restructuring a FTSE 10 health, hygiene and nutrition business into a multi business unit organisation.

Read moreIs digital and AI delivering what your business needs?

Digital and AI can solve your toughest challenges and elevate your business performance. But success isn’t always straightforward. Where can you unlock opportunity? And what does it take to set the foundation for lasting success?