Trending areas of focus for London Metal Exchange members

7 min read 22 July 2024

All businesses face challenges and are continuously looking to improve their capabilities and processes. This is particularly relevant for active members of the London Metal Exchange (LME). The diversity of LME members is vast, from specialised metals and commodity brokers to tier 1 investment banks, although the daily challenges they face are often the same.

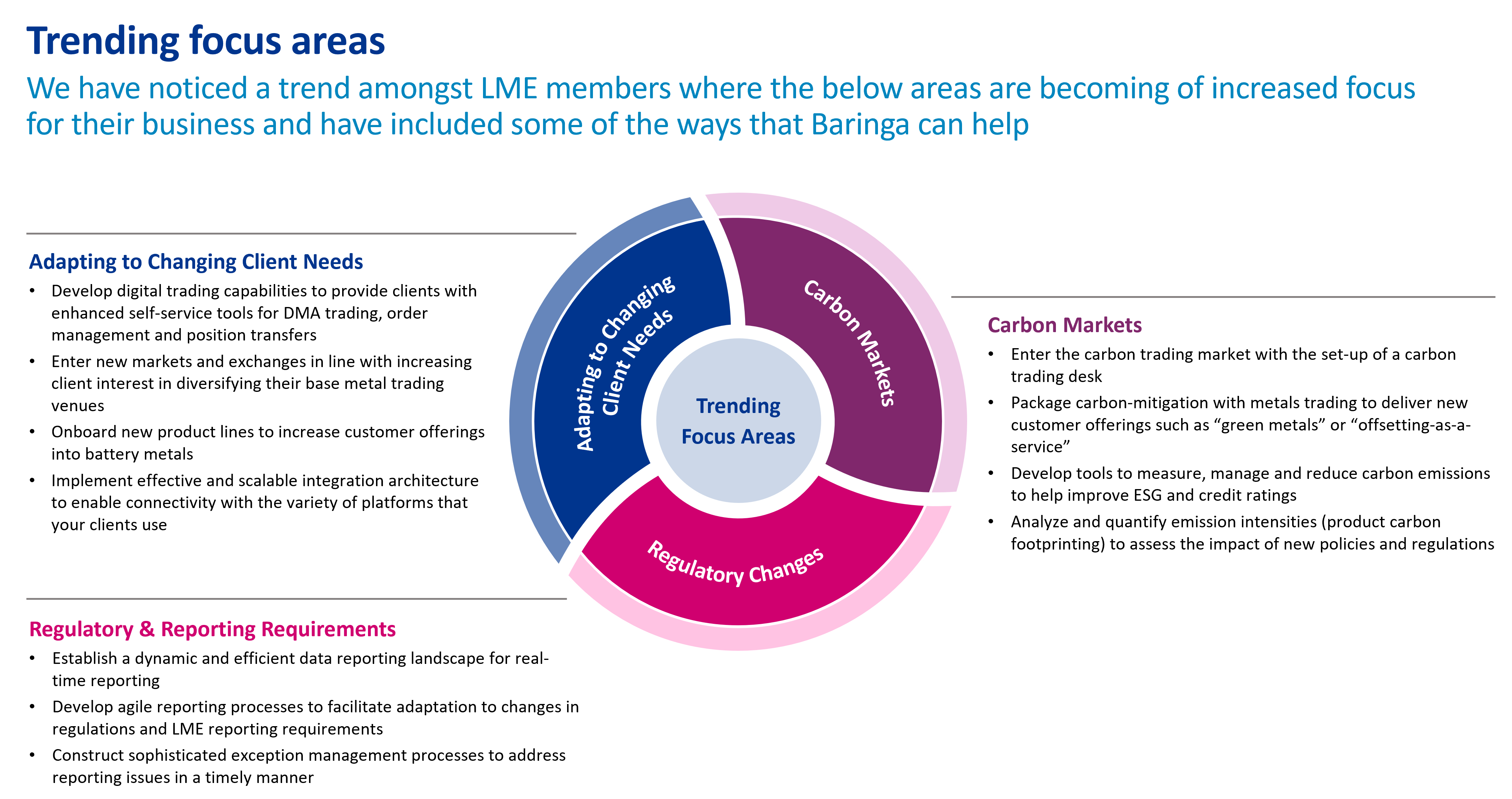

Across Baringa’s time working with a variety of LME members and market participants we have observed three key focus areas that consistently come up in conversation:

- Adapting to changing client needs

- Regulatory & reporting requirements

- Carbon markets

This article touches on each of these focus areas and suggests some measures that LME members might consider.

Adapting to changing client needs

Recognising the evolving nature of your clients' needs, which can vary significantly and change over time, is essential. A growing trend among clients of LME members is the desire for some level of self-service functionality to enable to them to easily trade without relying on traditional communication channels. As a result, some LME members have made investments in providing Direct Market Access (DMA) and pre-trade capabilities to meet these evolving client requirements.

Additionally, clients of LME members may have needs that extend beyond the scope of the LME market and may prefer other exchanges such as the Chicago Mercantile Exchange (CME) or the Shanghai Futures Exchange (SHFE). This shift has prompted several LME members to diversify their market offerings accordingly.

The ability to proactively position your business to address these diverse client needs or to adapt swiftly as new requirements arise is crucial for retaining client satisfaction and loyalty. With this in mind, we recommend that businesses look towards some or all of the following measures:

- develop digital trading capabilities to provide clients with enhanced self-service tools for DMA trading, order management and position transfers.

- enter new markets and exchanges in line with increasing client interest in diversifying their base metal trading venues.

- onboard new product lines to increase customer offerings into battery metals.

- implement effective and scalable integration architecture to enable connectivity with the variety of platforms that your clients use.

Regulatory & reporting requirements

Recently, there has been an observable shift in the expectations of markets and regulators, placing a growing emphasis on the information required from market participants. This trend is particularly noteworthy given the turbulent conditions experienced in the metals market over the past few years. For members of the LME this heightened demand for information holds significant relevance.

Given the unique and intricate nature of the LME market, members often find themselves employing various manual processes. This is especially true in the realm of regulatory and data reporting, particularly concerning exception management and the adoption of new reporting requirements. Even for LME members with a substantial non-LME presence, like investment banks, challenges may persist in adapting their established regulatory and data reporting processes to the nuances of LME reporting.

Failing to meet regulatory and data reporting requirements carries serious consequences, ranging from financial penalties to potential restrictions on regulated activities. We recommend that businesses give consideration towards the following measures:

- establish a dynamic and efficient data reporting landscape for real-time reporting.

- develop agile reporting processes to facilitate adaptation to changes in regulations and LME reporting requirements.

- construct sophisticated exception management processes to address reporting issues in a timely manner.

Carbon markets

Traditionally, carbon trading in both the compliance market and the voluntary market has been associated with a firm's broader energy trading business, driven by the heightened emphasis on carbon footprint within the energy sector. Interestingly, we are seeing more LME members showing an increased interest in incorporating environmentally friendly offerings to their clients, such as "green metal". This is in part due to more metals’ clients becoming keen on reducing their carbon footprint and, as a by-product, aiming to enhance their ESG and credit ratings – especially those close to the end-user.

To support this, we see metals clients seeking to leverage the industry expertise of LME members to explore relevant carbon-offsetting trading strategies – something that can be challenging in situations where there is a disconnect between an energy-focused carbon trading desk and a separate metals trading desk. This metals-specific carbon awareness is particularly valuable in navigating the relatively new Carbon Border Adjustment Mechanism (CBAM), which will see businesses taxed when goods imported into the EU (including aluminium, iron, and steel) have a higher carbon intensity versus similar EU produced goods.

Ensuring the provision of adequate support to clients within the carbon markets is crucial for fostering a sustainable future with them. As such, we recommend that businesses carefully consider some of all of the following measures:

- enter the carbon trading market with the set-up of a carbon trading desk.

- package carbon-mitigation with metals trading to deliver new customer offerings such as “green metals” or “offsetting-as-a-service”.

- develop tools to measure, manage and reduce carbon emissions to help improve ESG and credit ratings.

- analyze and quantify emission intensities (product carbon footprinting) to assess the impact of new policies and regulations.

If your organisation is also considering some or all of these focus areas, then we encourage you to reach out to us. Baringa brings a unique approach to driving value for clients with our deep metals and financial industry expertise. With the right level of support any business can achieve its goals of servicing its clients to the best of their ability whilst also meeting its daily obligations.

To discuss how our commodity and energy trading team can support you, contact Jordan Skilling.

Our Experts

Related Insights

How do commodity trading organisations become AI future-ready?

Commodity traders are incentivised to adopt AI, but face challenges with legacy integration.

Read more

Why most trading transformations fail – and how you can beat the odds

Discover the key pitfalls to avoid—and the four priorities that can help your business succeed where others have failed..

Read more

Unlock the key to successful trading transformation

Discover how Baringa helps energy and commodity businesses deliver faster, lower-cost change with lasting impact.

Read more

AI revolution in energy and commodity trading

On June 25th, Baringa, Salesforce, and Terranoha welcomed industry leaders from commodity trading, and technology in Geneva for an insightful conversation on how AI is transforming the trading world.

Read moreRelated Client Stories

Unlocking scalable growth in the private energy sector

A leading private energy company faced a critical challenge: its legacy systems were slowing down operations, limiting scalability, and creating friction across commercial and operational teams.

Read more

Progressing Western Australia’s energy transition

With growing urgency around net-zero targets, how can practical solutions be identified to unlock faster and more effective project delivery in the Wholesale Electricity Market?

Read more

Navigating transition risk and opportunities with Equitix

Join Energy and Resources Director Jim Fitzgerald, as he talks to our client Charlotte Whittlesea from the Sustainability and ESG team at Equitix about a recent project to integrate climate risk and opportunity considerations into Equitix’s investment lifecycle.

Read more

Securing financing to accelerate Southeast Asia’s clean energy future

How can solar project investors have a view on future revenues in a region with diverse markets?

Read moreIs digital and AI delivering what your business needs?

Digital and AI can solve your toughest challenges and elevate your business performance. But success isn’t always straightforward. Where can you unlock opportunity? And what does it take to set the foundation for lasting success?