The refinancing cliff: what it is, how it affects you, and how to survive it

Private sector faces $118bn of extra cost per year in US and UK alone.

6 min read 27 May 2024

The world is facing a “refinancing cliff”, with businesses paying billions of additional dollars per year due to the effect of higher interest rates. But few of the senior execs charged with coordinating their firms’ responses have professional experience of such a macroeconomic environment.

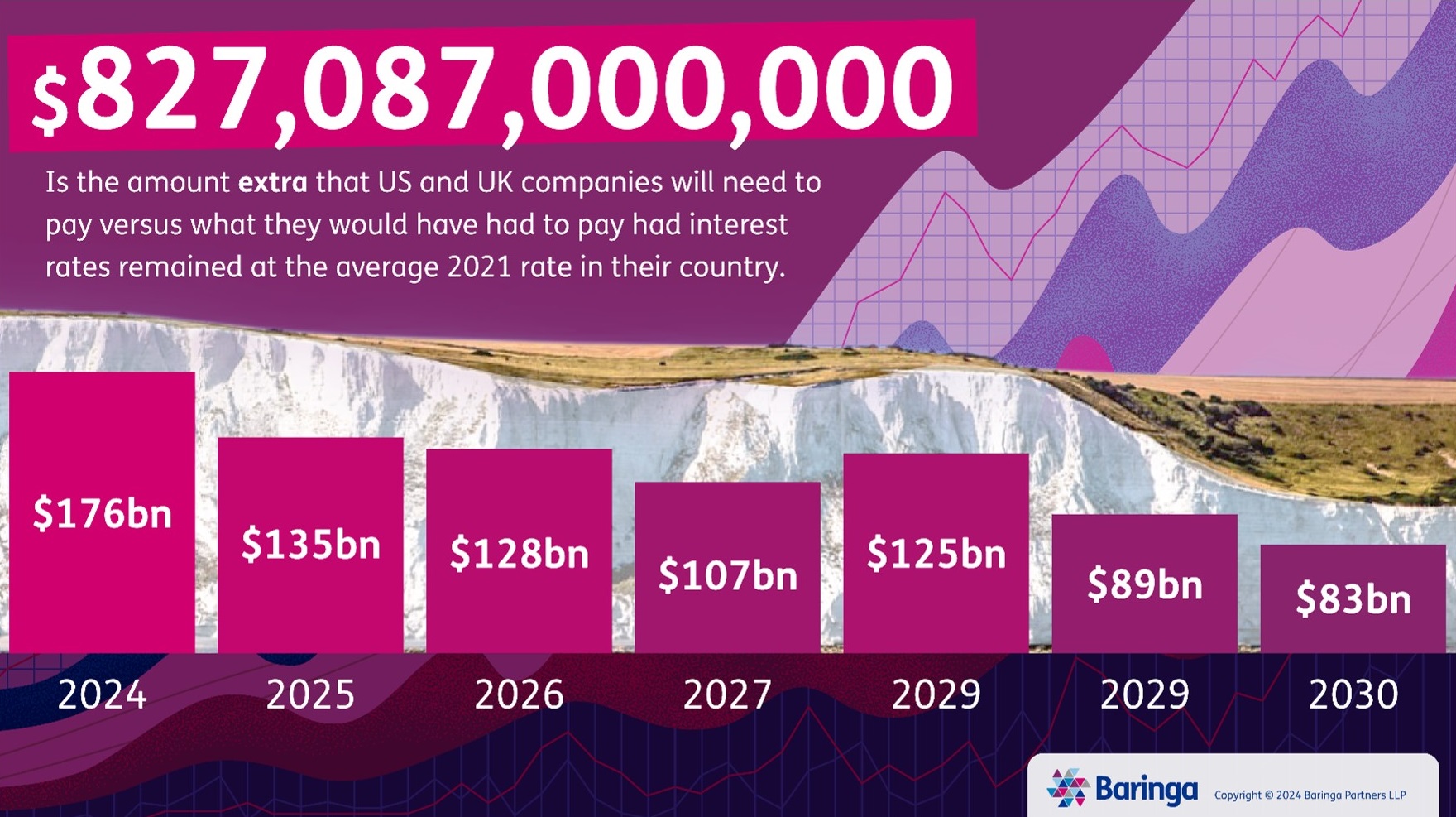

Between 2024 and 2030 inclusive, UK and US firms will pay in total $827bn more to service their debt than they would have done had that debt been refinanced at their country's average interest rate in 2021. This hike in borrowing costs will force action from indebted companies; from the financial service providers who issue that debt; and will affect customers and end-consumers, for whom goods and services may become more expensive.

In this article, we talk about what the refinancing cliff means for the private sector, and how companies are planning to respond.

Read our deep-dive into the specific impact on financial services firms here.

New figures demonstrate the size of the problem

Although interest rates are no longer heading upwards with the same speed as earlier in the decade, many private sector companies are only now beginning to feel the pain of those rate rises.

Companies who took out credit in 2021 or before, when interest rates were at rock-bottom, are seeing that credit mature and being refinanced at costs much higher than any seen in the past decade and a half. We've crunched the numbers and found that this year, in the UK and US alone, firms face paying $176bn more than they would have done had this year’s debt been refinanced at their country's average 2021 interest rate.

This problem is amplified by the lack of institutional knowledge of high interest rate environments, a consequence of rates having remained at historic lows for so long. We surveyed 500 CFOs, financial directors and senior treasurers of large firms in the UK and the US and found that almost all (98%) were experiencing an increase in the cost of refinancing or servicing debt, with two thirds (66%) reporting it was a “significant increase”. But less than a quarter (23%) of these top finance people reported having been senior enough to have been involved in strategic decisions before 2008 when rates sank to consistent lows.

This means that three quarters of the world’s senior finance professionals need to deal with an economic backdrop of which they have little professional experience. Even those with professional experience of high interest rates must draw on situations in which factors such as regulation, technology and the widespread uptake of social media were materially different.

How to tackle the problem

"This is a challenge the economy hasn’t faced for more than a decade. The tools, techniques and thinking that got us through the last ten years are not the tools, techniques and thinking that will get us through the next twenty-four months."

Nick Forrest, partner, Baringa

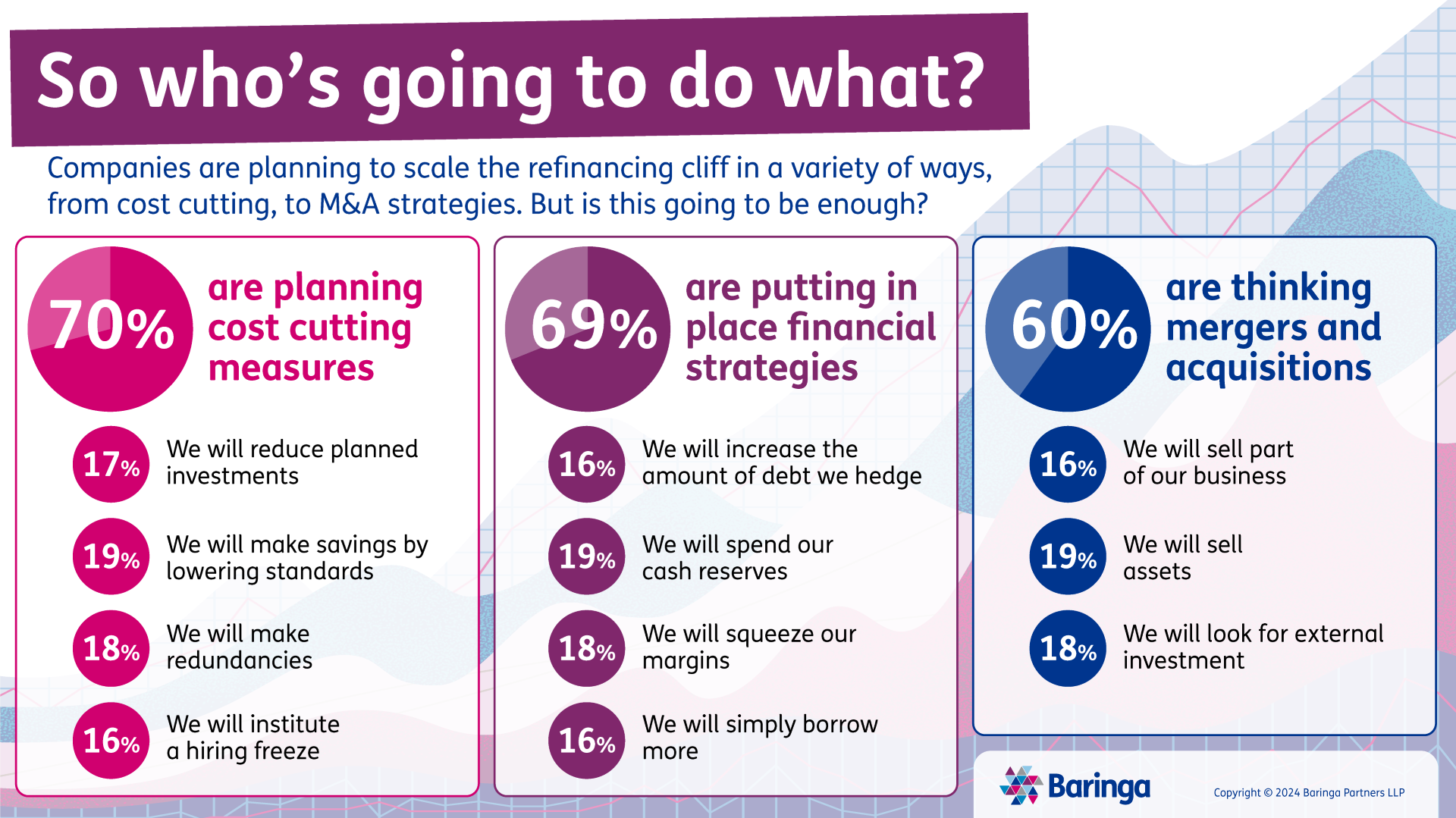

Companies and the financial services firms that support them need to reframe the challenge rather than treat it as business as usual. Instead, the response needs to be broken down into three main categories:

Prepare for a new macroeconomic environment

The refinancing cliff will have a profound effect on the economy. While we can’t precisely predict what form that effect will take, to maximise their chances of thriving, firms need to scope out a range of likely scenarios for their sector, so plans can be drawn up against each.

Possible scenarios include:

- A wave of mergers and acquisitions across industries, as companies are forced to sell to acquirers who can afford the debt they face.

- The volume of refinancing affecting the availability and price of credit.

- Corporate defaults and failures in some sectors.

- Companies raising prices for customers to pay for their increased debt costs, resulting in a pro-cyclical effect with an upward pressure on inflation.

Once scenario planning has been undertaken, companies need to stress-test against each scenario.

Prepare a financial plan

Organisations need to ensure they have a plan for how they will fund their ongoing operations under all likely scenarios. This should include:

- Cash optimisation – ensure best use is being made of funds available.

- A medium-term financing strategy – is the company’s liquidity guaranteed over a five-year time horizon, and how is it guaranteed?

- Refinancing strategy – what instruments will be used for finance, and is the timing of any refinancing optimum?

Banks and other lenders, in particular, need a new lending strategy and liquidity-optimisation strategy that takes account of the new conditions. They will also need to pay close attention to their lending strategy and how their clients and target sectors may be affected by higher refinancing costs.

As with their macroeconomic planning, the financial plan needs to involve a great deal of stress testing.

Prepare a business plan

There is no one-size-fits-all solution, but thinking needs to be conducted in advance as to how a firm’s core activities and operations could be changed to respond to the new environment. Tactics available to management include:

- Selling assets or business units.

- Cutting or raising prices.

- Internal efficiency drives.

- Reducing or deferring planned investments.

- Instituting hiring freezes or, at worst, considering redudancy rounds.

- Looking for external investment.

More broadly, businesses need to consider this as a key interconnecting risk of the type that needs to form part of an organisation’s risk management process.

For more information on how we can help your business with its financial risk management, visit our de-risking risk page.

Methodology

Refinancing cost data was based on all corporate loans and bonds available via data provider Factset, and was accessed on 1 May 2024. Assumptions about future interest rates used SONIA (UK) and SOFR (US) swap rates as proxies, and Bank of England yield curves. These were accessed on 30 April 2024. Where we refer to “interest rates at 2021”, we have based this on the average interest rate in both the UK and the US for this year.

The survey of CFOs and treasurers was conducted by independent market research consultancy Censuswide. The survey comprised of 250 CFOs, Financial directors, and treasurers working in mid-sized firms and above (500 headcount and £50m turnover minimum) across the UK. It was run online between the 15th and 27nd of March 2024. Censuswide is a member of the British Polling Council and is BHBIA certified, employing members of the Market Research Society which is based on the ESOMAR principles.

Our Experts

Related Insights

Why banks fail

After a decade of relative calm, a series of sharp and sudden failures hit the banking industry hard. They’ve prompted many post-mortem analyses, discussions, and regulatory recommendations. But are other institutions really taking the lessons learned to heart?

Read more

How do super CROs navigate the double-edged sword of AI?

Explore how AI is transforming risk management for superannuation funds and the strategies Chief Risk Officers are using to navigate the complexities of the modern financial landscape.

Read more

Four steps to comply with the updated BCBS239 regulations

Banks have spent millions on BCBS239 compliance, but they aren’t yet in the clear. In case you missed it, the ECB recently published new guidance that updates the decade-old regulation. Here are the four actions that we recommend firms take to meet the latest BCBS239 rules.

Read more

AI risk management: are financial services ready for AI regulation?

Find out how AI is transforming financial services and the crucial need for proactive risk management and compliance in the evolving regulatory environment.

Read moreRelated Client Stories

Delivering regulatory change for UK building society

How can a UK building society deliver regulatory change while ensuring a great customer experience?

Read more

Keeping large-scale capital investment on track

How do you independently assess the governance and maturity of a multi-billion program?

Read more

Equipping a UK building society to fight financial crime

How do you create a technology platform that can stay one step ahead of financial criminals?

Read more

Using regulatory change as an opportunity to strengthen and rationalise internal controls

As UK regulators plan an Internal Controls and Governance directive, this major insurer seized the opportunity to achieve its long-term ambition.

Read moreIs digital and AI delivering what your business needs?

Digital and AI can solve your toughest challenges and elevate your business performance. But success isn’t always straightforward. Where can you unlock opportunity? And what does it take to set the foundation for lasting success?